Are double-cab pickups now classed as cars?

New tax guidance from HMRC will categorise double-cab pickups as company cars starting from 1 July 2024. The updated regulations relate to all double-cab pickups that are placed on order after 1 July 2024.

For years, the double-cab pickup truck has gained popularity due to favourable tax regulations, possibly more than any other vehicle in the UK car market. The longstanding appeal of double-cab pickups has been their classification as commercial vehicles. This means that there was previously either no tax benefit on such vehicles when there was only “incidental personal use”, and only a small taxable benefit where there was some personal use. The reclassification of double-cab pickups as cars will lead to a substantial tax increase for double-cab users. They will now pay benefit-in-kind tax based on the company car tax system, determined by the vehicle's list price and CO2 emissions.

N.B.

There are no “incidental use” rules for cars. Home-to-work travel will trigger a taxable benefit.

So what has changed?

The previous requirement of a minimum 1,000kg payload is no longer in effect, and any double-cab pickup equipped with a second row of seats will now be subject to company car tax.

What are the tax implications?

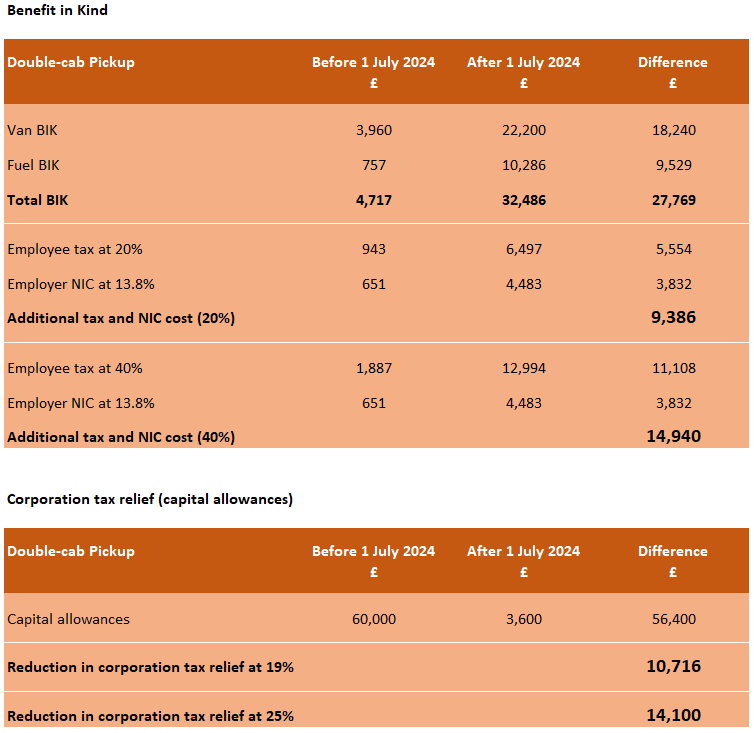

The tax implications are huge. Firstly, it is important to note that not only will double-cab pickups be treated as cars for benefit-in-kind purposes, but also for capital allowance purposes i.e. reduced corporation tax relief on the purchase of the vehicle.

Benefit in kind

Currently, if there is some private use of the vehicle, the benefit in kind on double-cab pickups is at a flat rate of £3,960, which is £792 for a basic rate (20%) tax payer and £1,584 for a higher rate (40%) tax payer.

If the company also paid for any private fuel, the benefit currently is £757, which is £151.40 for a basic rate (20%) tax payer and £302.80 for a higher rate (40%) tax payer.

The employer’s NI contributions would also be based on these values, but it is payable at 13.8%, instead of 20% or 40%.

However, when the new system is in place, there will no longer be a flat rate applied to double-cab pickups, and instead, the benefit will be based on the list price of the vehicle and the associated CO2 emissions, the same as all “cars”.

Corporation tax relief

In the current system, a business can reclaim tax relief on up to 100% of the cost of the vehicle in the year of purchase against any business profits. However, from 1 July 2024, it is likely that a business will only be able to claim 6% to 18% (based on CO2 emissions) in each year following the purchase of the vehicle.

Example

The most common double-cab pickup in the UK is the Ford Ranger with a list price of around £60,000, with CO2 emissions of over 200g/km. This puts the vehicle in the 37% tax bracket meaning that the benefit in kind value is £22,200. The tables below show the impact on both the benefit in kind tax and corporation tax.

N.B.

Vehicles already in the fleet or ordered before July will retain their existing classification until April 2028. Therefore, it might be worth keeping your current double-cab pickup in order to avoid the significant tax increases from 1 July 2024.

What about VAT?

While the company car tax classification of pickup trucks is set to change from July 2024, they will remain classified as commercial vehicles for VAT purposes. This VAT approach for double-cab pickups is differentiated based on payload, with anything under one tonne classified as a car, and anything a tonne and over as a van. This rule, it says was replicated as a “pragmatic way” of resolving the primary suitability and classification of double-cab pickups.

Where sole traders are concerned, there will be private restriction use applied to the VAT reclaim where there is private use.