Making Tax Digital for Income Tax: The End of Period Statement (EOPS) Has Been Removed

If you have been reading about Making Tax Digital for Income Tax (MTD ITSA), you may have come across references to something called an End of Period Statement (EOPS). You are not alone, as many guides, software training sessions, and older articles still mention it. This change has not been widely publicised, which is why EOPS is still referenced in some software training and online guides

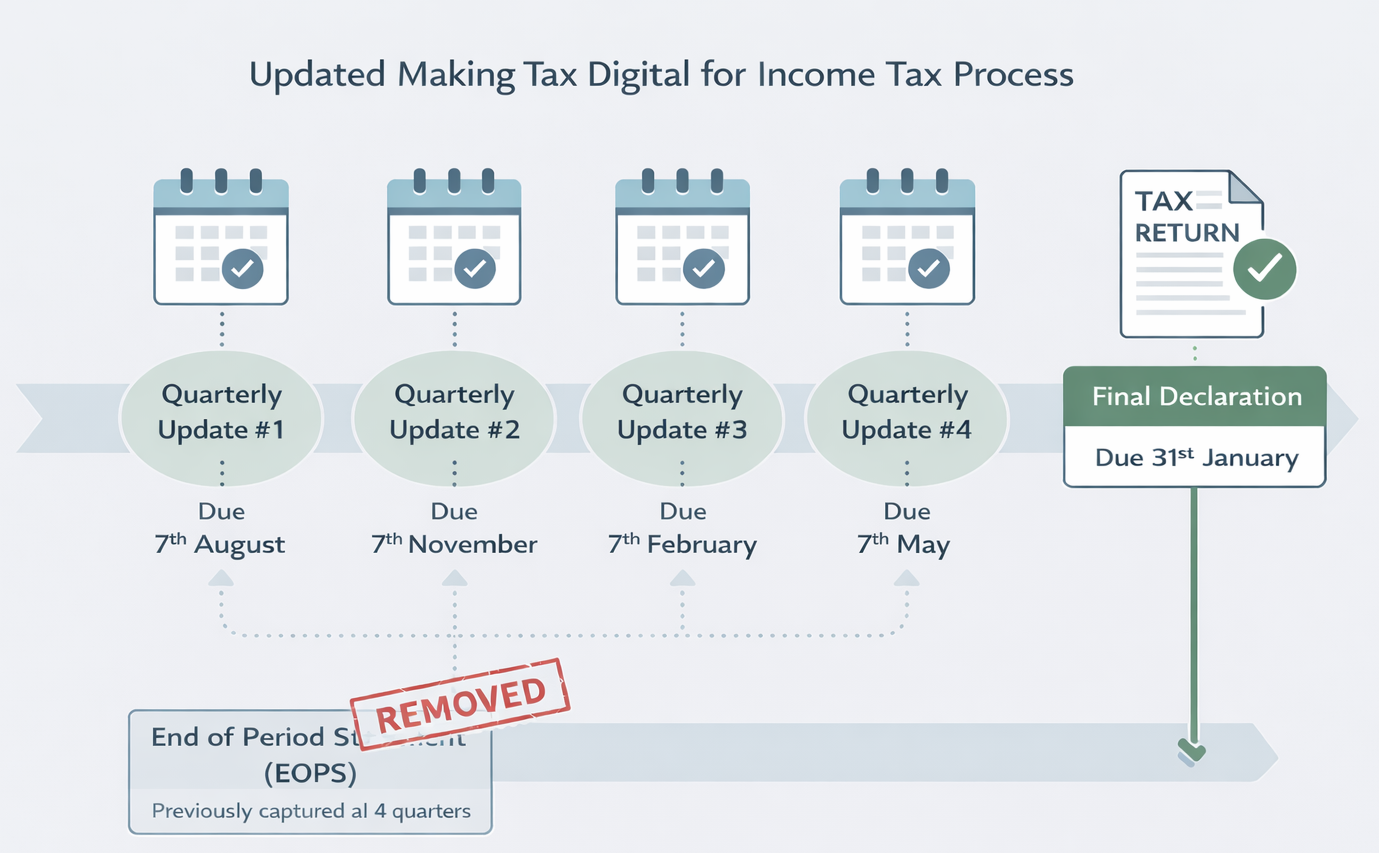

However, under the current HMRC design, the EOPS has been removed.

So what’s changed?

When MTD ITSA was first proposed, the process involved:

quarterly updates during the tax year

an End of Period Statement (EOPS)

and then a final tax return (“crystallisation”)

HMRC has since simplified the model.

Under the latest MTD ITSA design:

There is no separate End of Period Statement

All year-end accounting and tax adjustments are made through one submission only:

the Final DeclarationThe Final Declaration replaces:

the traditional Self Assessment tax return, and

the former EOPS step

In short, EOPS no longer exists as a separate filing requirement.

Why do some guides and software training still mention EOPS?

This is where much of the confusion comes from.

Some HMRC technical (developer) documentation still contains legacy terminology

Some software providers’ training materials have not yet been fully updated

Older blogs and articles continue to circulate online

These references reflect earlier versions of the MTD ITSA design, not the current compliance process.

HMRC’s current taxpayer journey is:

Submit quarterly updates during the year (summary figures only)

Submit a Final Declaration after the year end

There is no additional EOPS submission in between.

How quarterly updates and the Final Declaration work

It’s also important to understand that:

Quarterly updates are informational

They are not final

They are not tax-adjusted

They do not feed into or populate the Final Declaration

The Final Declaration is a standalone annual submission, based on the final accounts and tax computations prepared at the year end — much like the Self Assessment return works today.

Key takeaway

Despite what you may still hear or see elsewhere:

There is no separate End of Period Statement under the current MTD for Income Tax rules.

If you have questions about how MTD ITSA will apply to you — particularly if you’re a landlord or small business — please get in touch. We’re keeping a close eye on HMRC developments so you don’t have to.