Should you incorporate your business in 2023?

After a period of uncertainty, the Autumn Statement 2022 provided clarity on the changes affecting profit extraction for small company owners. What are the key points, and does it still make sense to incorporate for businesses that aim to grow?

Choosing a trading vehicle - a recap

The choice of business structure determines the taxes and National Insurance (NI) contributions that need to be paid. If a client operates as a sole trader, they will pay income tax on their profits. These profits, along with any other income, will be combined to calculate the client's total taxable income for the year. Self-employed clients will also have to pay Class 2 and Class 4 National Insurance contributions if their profits exceed certain thresholds.

However, if the client chooses to operate through a limited company, the company becomes a separate legal entity and is subject to corporation tax on its profits. If the client wants to use those profits personally, they must be extracted from the company. There are various options for profit extraction, but a common strategy is to take a small salary and receive dividends. Depending on the salary level and the client's other income, income tax and National Insurance contributions may need to be paid by both the client and the company. However, the salary is typically set at a level that minimises National Insurance contributions.

N.B.

It is important to ensure that clients considering incorporation understand that the company is a separate legal entity. Failing to recognise this distinction can lead to improper appropriation of company funds by the owner.

Dividends can only be paid out of retained profits, which have already been subject to corporation tax. Dividends are initially taxed at a zero rate if they are within the dividend allowance (current year £1,000) and any unused personal allowance. After that, they are taxed at the appropriate dividend tax rate, treated as the highest slice of income.

Changes - April 2023

Corporation tax rate: Starting from April 2023, the corporation tax rate will increase to 25% for standalone companies with profits exceeding £250,000. A small profits rate, equivalent to the current rate of 19%, applies to profits of £50,000 or less. For profits between these thresholds, the effective rate ranges from 19% to 25%, calculated at 25% of taxable profits minus marginal relief. This increase will not affect standalone companies with taxable profits of £50,000 or less. However, personal and family companies with higher taxable profits will pay more corporation tax from April 2023, reducing the available profits for dividend extraction.

Bands and rates: The personal allowance and basic rate bands remain unchanged for 2023/24, at £12,570 and £37,700 respectively (meaning that income exceeding £50,270 is subject to higher rate tax of 40%). However, the additional rate threshold (the highest income tax threshold) has dropped to £125,140. The NI thresholds are also been frozen.

Dividends: Starting from April 6, 2023, the dividend allowance decreased to £1,000 from the previous level of £2,000. This reduction will limit the amount of tax-free dividends that can be extracted and diminish the advantage of utilising an alphabet share structure to make use of the dividend allowance for family members. The dividend tax rates, which were increased by 1.25% on 6 April 2022, as part of health and social care measures, will remain at that level, despite the cancellation of the Health and Social Care Levy and temporary NI increase. The dividend tax rates for 2023/24 will be 8.75% for dividends falling within the basic rate band, 33.75% for dividends in the higher rate band, and 39.35% for dividends in the additional rate band.

Impact on owner-managed businesses

When we examine how these changes will affect the comparison between operating a company versus being a sole trader, assuming a profit extraction strategy that involves a salary of £12,570 and the remaining profits extracted as dividends.

N.B.

This may not be the optimal strategy; we are simply making this assumption to simplify the analysis.

The following table shows the tax and NI payable by a single director company and an individual at three different profit levels:

Note that once adjusted income surpasses £125,140, the personal allowance is completely eliminated. This implies that tax will be paid on the first £1 of income at this threshold (excluding dividends covered by the dividend allowance).

N.B.

The dividend allowance will further decrease to only £500 starting from April 2024.

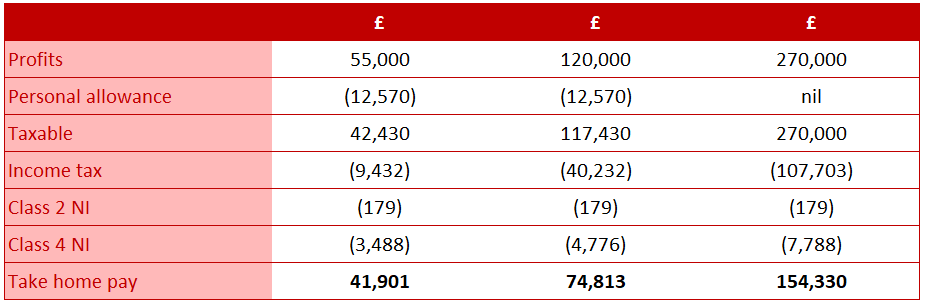

When we examine how the sole trader will perform at the same profit levels:

Conclusion

The comparison reveals a familiar pattern that has been consistent since the changes to dividend tax in 2016. Incorporation remains advantageous at relatively moderate profit levels, but as profits substantially increase, the sole trader retains more benefits.

It is important to note that the advantages are relatively small. The difference in favour of the company owner at the two profit levels is only around £1,800. Considering that companies face higher administrative burdens compared to unincorporated businesses, these modest savings may not be compelling enough to justify incorporation based solely on tax and NI considerations. However, this does not mean that incorporation should be completely disregarded. Several factors need to be taken into account when advising clients:

The examples assume that all profits are extracted. A more favourable outcome can be achieved by restricting profit extraction, such as ensuring the director shareholder remains outside the personal allowance abatement range.

The company example is based on a single director shareholder. Significant improvements can be made by utilising multiple tax allowances and basic rate bands, such as involving a spouse or civil partner as a second shareholder.

The examples assume no other sources of income. In reality, other income should be taken into consideration to devise an optimal profit extraction strategy.

The overall conclusion is that while incorporation can still provide tax and NI savings, there is no one-size-fits-all solution. Advice should be tailored to each client's individual circumstances.

Additionally, there are several non-tax incentives for incorporation, including:

Limited liability protection for personal assets.

Perceived prestige associated with a limited company.

Ensuring continuity of the business in the long term.

Ease of succession planning.

The key changes that will impact clients' profit extraction are the reinstatement of the corporation tax main rate increase to 25%, the retention of higher dividend rates, and the reduction of the dividend allowance. However, from a tax perspective, incorporation can still be beneficial, especially if profits can be retained within the company or multiple family shareholders are involved.